Cheniere Energy, Inc. (“Cheniere”) (NYSE American: LNG) reported net income1 of $197 million, or $0.78 per share - basic and diluted for the three months ended June 30, 2020, compared to a net loss of $114 million, or $0.44 per share - basic and diluted, for the comparable 2019 period. Net income increased during the three months ended June 30, 2020 as compared to the comparable 2019 period primarily due to increased total margins3 and decreased net loss related to interest rate derivatives, partially offset by (i) increased income attributable to non-controlling interest, (ii) increased income tax expense, (iii) costs incurred in response to the COVID-19 pandemic, (iv) increased loss on modification or extinguishment of debt, and (v) increased interest expense. Total margins increased during the three months ended June 30, 2020 primarily due to accelerated revenues recognized from LNG cargoes for which customers have notified us that they will not take delivery and an increase in margins per MMBtu of LNG delivered to customers and recognized in income, partially offset by net losses from changes in fair value of commodity derivatives and a decrease in volumes of LNG recognized in income primarily due to cargoes for which long-term customers have not elected delivery.

Cheniere reported net income of $572 million, or $2.27 per share-basic and $2.26 per share-diluted for the six months ended June 30, 2020, compared to $27 million, or $0.11 per share-basic and diluted, for the comparable 2019 period. Net income increased during the six months ended June 30, 2020 as compared to the comparable 2019 period primarily due to increased total margins, partially offset by (i) increased interest expense, (ii) increased income tax expense, (iii) increased operating and maintenance expenses primarily due to additional Trains in operation and costs incurred in response to the COVID-19 pandemic, (iv) increased income attributable to non-controlling interest, and (v) increased loss on modification or extinguishment of debt. Total margins increased during the six months ended June 30, 2020 primarily due to accelerated revenues recognized from LNG cargoes for which customers have notified us that they will not take delivery, an increase in LNG volumes recognized in revenue primarily due to additional Trains in operation, increased net gains from changes in fair value of commodity derivatives, and slightly increased margins per MMBtu of LNG delivered to customers and recognized in income.

Margins per MMBtu of LNG delivered to customers and recognized in income increased during the three and six months ended June 30, 2020 primarily due to an increase in the proportion of volumes sold pursuant to higher-margin long-term contracts, partially offset by a decrease in market pricing for short-term cargoes sold.

Consolidated Adjusted EBITDA was $1.39 billion for the three months ended June 30, 2020, compared to $615 million for the comparable 2019 period. The increase in Consolidated Adjusted EBITDA during the three months ended June 30, 2020 was primarily due to accelerated revenues recognized from LNG cargoes for which customers have notified us that they will not take delivery and increased margins per MMBtu of LNG delivered to customers and recognized in income, partially offset by a decrease in volumes of LNG recognized in income primarily due to cargoes for which long-term customers have not elected delivery.

Consolidated Adjusted EBITDA was $2.43 billion for the six months ended June 30, 2020, compared to $1.27 billion for the comparable 2019 period. The increase in Consolidated Adjusted EBITDA during the six months ended June 30, 2020 was primarily due to accelerated revenues recognized from LNG cargoes for which customers have notified us that they will not take delivery, an increase in LNG volumes recognized in income primarily due to additional Trains in operation, and slightly increased margins per MMBtu of LNG delivered to customers and recognized in income, partially offset by increased operating and maintenance expenses primarily due to additional Trains in operation.

During the three and six months ended June 30, 2020, we recognized $708 million and $761 million, respectively, in revenues associated with LNG cargoes for which customers have notified us that they will not take delivery, of which $458 million would have otherwise been recognized subsequent to June 30, 2020, if the cargoes were lifted pursuant to the delivery schedules with the customers. LNG revenues during the three months ended June 30, 2020 excluded $53 million that would have otherwise been recognized during the quarter if the cargoes were lifted pursuant to the delivery schedules with the customers, as these revenues were recognized during the three months ended March 31, 2020. Excluding the impact of cargo cancellations related to periods subsequent to June 30, 2020 and those received in prior periods for the current periods, our total revenues would have been $2.00 billion and $4.65 billion for the three and six months ended June 30, 2020, respectively.

During the three and six months ended June 30, 2020, 78 and 206 LNG cargoes, respectively, were exported from our liquefaction projects, none of which were commissioning cargoes. One cargo exported from our liquefaction projects and sold on a delivered basis was in transit as of June 30, 2020.

“We delivered strong results for the second quarter of 2020, despite the challenging LNG market environment and continued global impact of the COVID-19 pandemic, which further proves the resiliency and strength of Cheniere’s business model,” said Jack Fusco, Cheniere’s President and Chief Executive Officer.

“Our customers value the flexibilities our long-term contracts provide, which enable LNG buyers to effectively manage their portfolios through various market conditions, while continuing to underpin Cheniere’s financial stability. Despite continued market challenges, our visibility on achieving our financial goals for the year is unchanged, and today we are reconfirming our full year 2020 guidance of $3.8 to $4.1 billion in Consolidated Adjusted EBITDA and $1.0 to $1.3 billion in Distributable Cash Flow.”

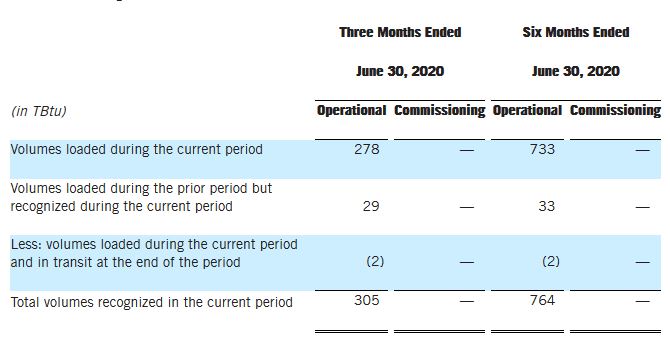

LNG Volume Summary

The following table summarizes the volumes of operational and commissioning LNG that were loaded from our liquefaction projects and for which the financial impact was recognized on our Consolidated Financial Statements during the three and six months ended June 30, 2020:

In addition, during the three and six months ended June 30, 2020, we recognized the financial impact of 34 TBtu and 48 TBtu of LNG, respectively, on our Consolidated Financial Statements related to LNG cargoes sourced from third parties.

Cargo Cancellation Revenue Summary

The following table summarizes the timing impacts of revenue recognition related to cargoes for which customers elected to not take delivery on our revenues for the three and six months ended June 30, 2020 (in millions):

Additional Discussion and Analysis of Financial Condition and Results

Details Regarding Second Quarter and Year-to-Date June 30, 2020 Results

Our financial results are reported on a consolidated basis. Our ownership interest in Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE American: CQP) as of June 30, 2020 consisted of 100% ownership of the general partner and a 48.6% limited partner interest.

Income from operations increased $505 million and $1.2 billion during the three and six months ended June 30, 2020, respectively, as compared to the comparable 2019 periods, primarily due to increased total margins as detailed above, partially offset by costs incurred in response to the COVID-19 pandemic. During the six months ended June 30, 2020, the increase was also partially offset by increased operating and maintenance expenses primarily due to additional Trains in operation.

Selling, general and administrative expense included share-based compensation expenses of $19 million and $38 million for the three and six months ended June 30, 2020, respectively, compared to $23 million and $43 million for the comparable 2019 period.

Capital Resources

As of June 30, 2020, we had cash and cash equivalents of $2.0 billion on a consolidated basis, of which $1.3 billion was held by Cheniere Partners. In addition, we had current restricted cash of $505 million designated for the following purposes: $167 million for the SPL Project, $101 million for the CCL Project and $237 million for other restricted purposes.

Liquefaction Projects

SPL Project

Through Cheniere Partners, we operate five natural gas liquefaction Trains and are constructing one additional Train for a total production capacity of approximately 30 million tonnes per annum (“mtpa”) of LNG at the Sabine Pass LNG terminal (the “SPL Project”).

CCL Project

We operate two Trains and are commissioning one additional Train for a total production capacity of approximately 15 mtpa of LNG near Corpus Christi, Texas (the “CCL Project”).

Corpus Christi Stage 3

We are developing an expansion adjacent to the CCL Project for up to seven midscale Trains with an expected total production capacity of approximately 10 mtpa of LNG (“Corpus Christi Stage 3”). We expect to commence construction of the Corpus Christi Stage 3 project upon, among other things, entering into an engineering, procurement, and construction contract and additional commercial agreements, and obtaining adequate financing.